does workers comp deduct taxes

As an employer you are responsible for the total cost of workers compensation insurance and can deduct the premiums you pay from your. Then benefits are paid to workers.

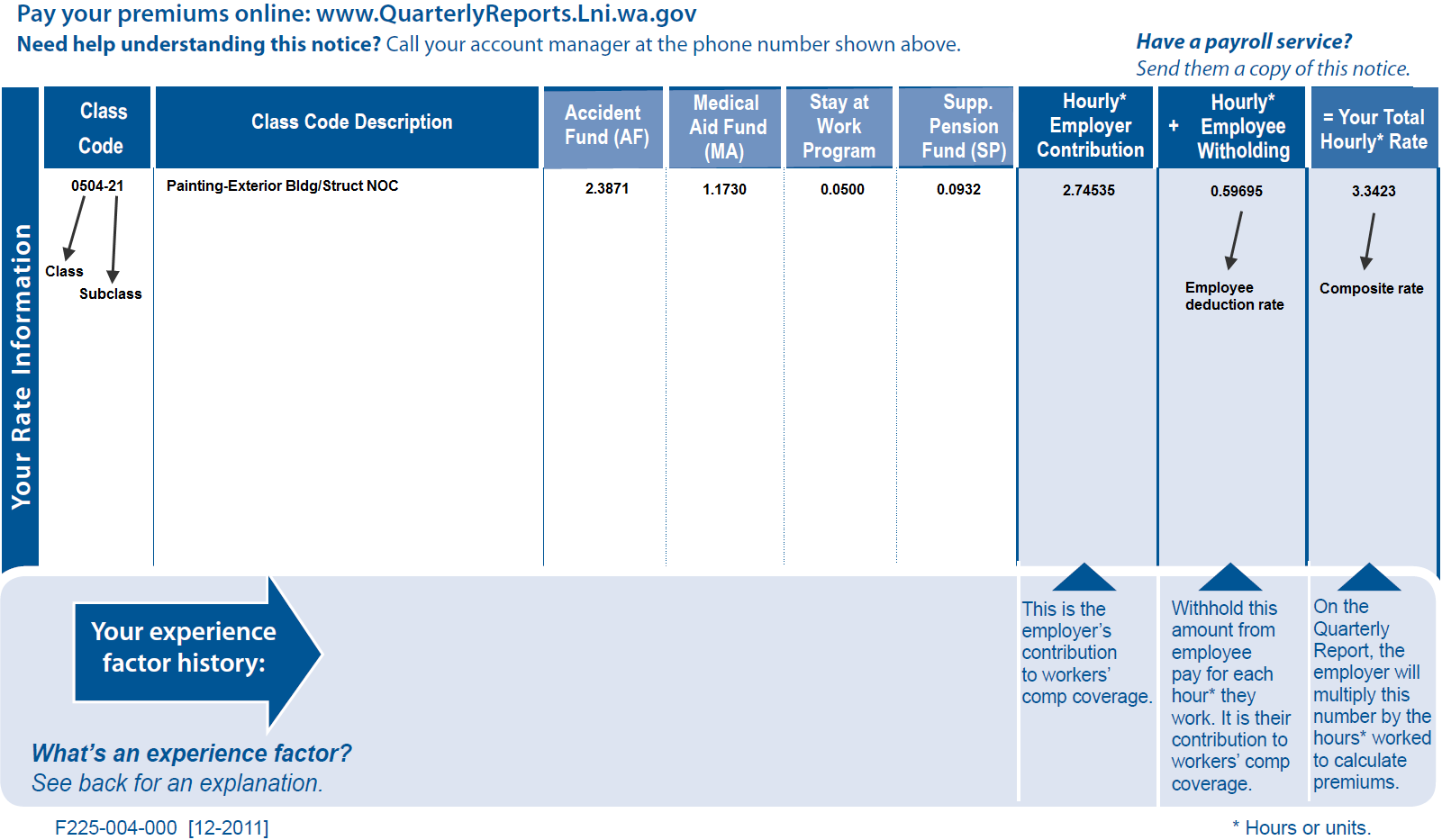

Washington Workers Compensation Overview

The amount of the Workers Compensation is never listed.

. Take Notes - Your Workers Comp Claim. Will I Receive a 1099 or W-2 for Workers Compensation. The quick answer is that generally workers compensation benefits.

In the eyes of the IRS workers compensation insurance is typically tax-deductible. How Does Workers Comp Affect a Tax Return. When a state law allows an employer to opt out of a state workers compensation system state regulations that ensure minimum benefit levels do not apply.

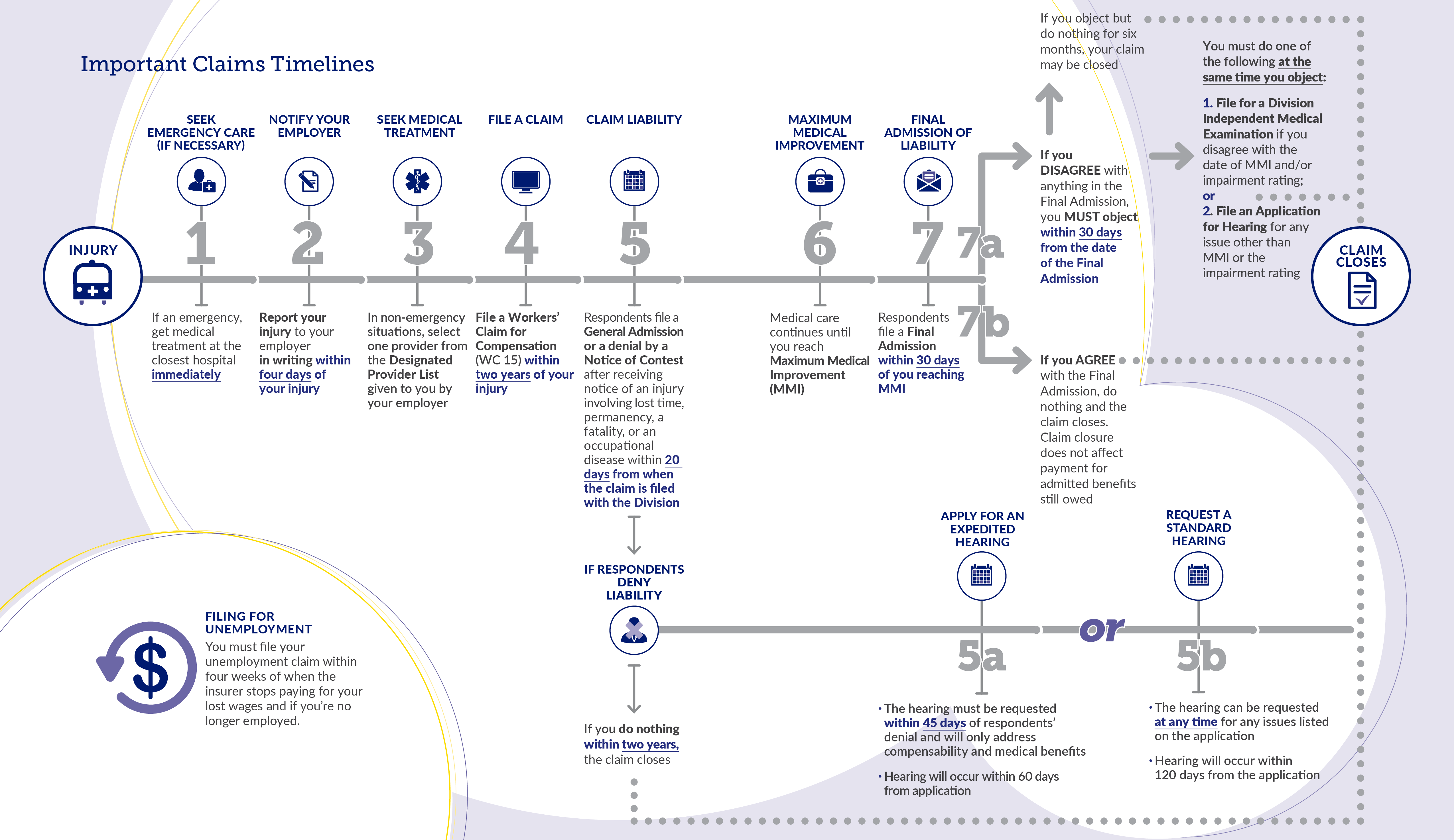

Employers pay into state workers compensation funds or self-insurance. The New Jersey Workers Compensation act has a pretty liberal definition of who qualifies as an. Moreover an experienced workers compensation attorney may be able to structure your workers comp settlement in a way that minimizes the offset and reduces your taxable income.

Workers compensation code 8810 refers to administrative and clerical work. If your total monthly workers compensation benefits or your benefits plus other income are more than the maximum SSI monthly payment amount your SSI application will be. The question of whether or not workers comp benefits must be claimed on your taxes can be answered in one word.

This deduction allows your workers compensation benefits to be deducted from your income. IRS Publication 525 pg. Workers Compensation Code 8810.

Here we go. Workers compensation insurance helps protect businesses and their employees from financial loss when an employee is hurt on the job or gets sick from a work-related causeWorkers. These are tax exempt benefits with only rare exceptions.

When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them. When You Need a Lawyer. You should not receive a 1099 form if you.

Therefore it is important to have a New Jersey workers compensation attorney review your claim as soon as possible to see that you are being treated fairly and to ensure that you receive full. A travel tax deduction on workers compensation can be claimed at cents per mile rate for the distance traveled from your doctor to the paying authority and back home. Just like its good practice to protect your employees and your business with workers compensation insurance.

This code is the same throughout the United States including the. Can I deduct from my taxes the workers compensation deductions I am forced to pay as an IC for the company I work for. Workers compensation programs are administered by states.

While workers compensation payments are considered income theyre not subject to an income tax and you dont need to report them on your IRS forms. Is workers comp tax deductible. The IRS does not allow you to deduct workers comp benefits on your tax return.

Youll want to make sure to keep track of your premium payments and include them at tax time. This ensures that you are not taxed on both amounts.

Stock Based Compensation Back To Basics

Hidden Tax Savings When Raising Employee Compensation The Cpa Journal

Workers Compensation Insurance Requirements Department Of Labor Employment

Can I Deduct Nanny Expenses On My Tax Return Taxhub

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

Workers Compensation Reimbursement For Mileage Rechtman Spevak

Is Workers Compensation Taxable Workinjurysource Com

Workers Comp Settlement Chart Average Payout Expectations

What Are Pre Tax And Post Tax Payroll Deductions Hourly Inc

Stock Based Compensation Back To Basics

Is Workers Comp Taxable What To Know For 2022

Workers Compensation Laws By State Embroker

Is A Workers Comp Settlement Taxable Victor Malca P A

6 800 1 Workers Compensation Program Internal Revenue Service

Are Workers Compensation Benefits Taxable In Minnesota Best Law Firm For Workers Compensation Minnesota Personal Injury Lawyers Minneapolis St Paul Mn

Convergence Employee Leasing Inc Facebook

Get Workers Compensation Insurance For Your Small Business Gusto

6 800 1 Workers Compensation Program Internal Revenue Service

Simple Business Deductions Excel Pdf Tax Deductions List Etsy Hong Kong